Order Manager

Version 8

Order Manager

Version 8

Contents of this Topic: Show

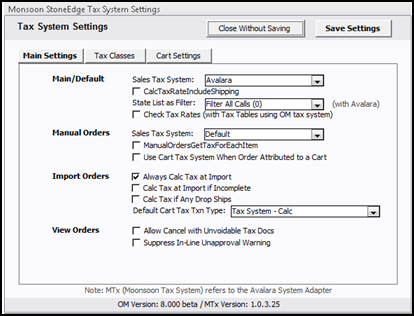

Tax System Settings provides a single interface from which you can set tax-related system parameters.

Tax System Settings can only be accessed by Admin UserIDs.

select this to abandon your changes and close the screen

if you have made changes to the cart-based parameters and selected the Save button on that tab, the tax system settings are re-initialized when this button is selected

select this to retain the changes you've made during this session anywhere except for the cart-based parameters, which should be Saved by the button on that tab

the tax system settings are re-initialized without exiting the program

sets main system parameter SalesTaxSystem

choices are currently Avalara or Order Manager

if selected, sets main system parameter CalcTaxRateIncludeShipping to TRUE

if cleared, system parameter CalcTaxRateIncludeShipping is set to FALSE

applies to the Avalara integration

sets main system parameter SalesTaxStatesListUsage

the choices are:

Filter All Calls (0)

Only Filter Custom Calls (1)

Do Not Filter Any Tax Calls (2)

sets main system parameter ManualOrdersSalesTaxSystem

the choices are:

Avalara

Order Manager

Default

if selected, sets main system parameter ManualOrdersGetTaxForEachItem to TRUE

if cleared, system parameter ManualOrdersGetTaxForEachItem is set to FALSE

sets main system parameter ManualOrdersUseCartTaxSystem to TRUE

if cleared, system parameter ManualOrdersUseCartTaxSystem is set to FALSE

sets system parameter AlwaysCalcTaxAtImport to TRUE

if cleared, system parameter AlwaysCalcTaxAtImport is set to FALSE

sets system parameter CalcTaxAtImportIfIncomplete to TRUE

if cleared, system parameter CalcTaxAtImportIfIncomplete is set to FALSE

sets system parameter CalcTaxIfAnyDropShips to TRUE

if cleared, system parameter CalcTaxIfAnyDropShips is set to FALSE

the choices are:

Tax Tables

Tax System - Calc

Tax System - Paid

Tax System - Saved

sets system parameter AllowCancelWithUnvoidableTax to TRUE

if cleared, system parameter AllowCancelWithUnvoidableTax is set to FALSE

if selected,sets system parameter SuppressInLineUnapprovalWarning to TRUE

if cleared, system parameter SuppressInLineUnapprovalWarning is set to FALSE

If TRUE, the user is NOT presented with the warning dialog box stating the change the user is about to make to an approved order (such as adding an item) will result in automatic unapproval of the order. The dialog box gives the user a chance to abort the change.

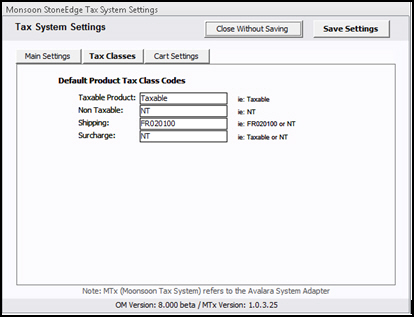

enter the sales tax code to use for taxable products

if this field is left empty, the program default is "Taxable"

enter the sales tax code to use for non-taxable products

if this field is left empty, the program default is "NT"

enter the sales tax code to use for shipping

if this field is left empty, the program default is "FR020100"

enter the sales tax code to use for surcharges

if this field is left empty, the program default is "NT"

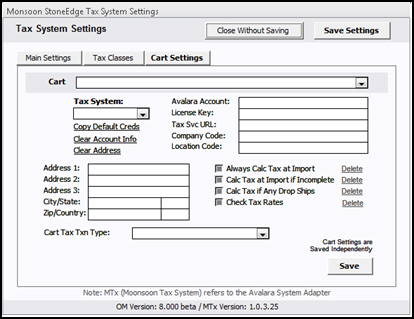

use the fields on this tab to set cart-based sales tax parameters

select a cart from the list of defined carts and then make changes one or more of the other fields on this screen to set the cart-based parameters

select the appropriate setting for system parameter SalesTaxSystem

Order Manager

Avalara

Default

copies the credentials from the main system parameters into the cart-based parameters for the selected cart

clears all account information from the cart-based parameters for the selected cart

clears all of the address information from the cart-based system parameters

sets cart-based system parameter TaxAddress1

sets cart-based system parameter TaxAddress2

sets cart-based system parameter TaxAddress3

sets cart-based system parameters TaxCity and TaxState, respectively

sets system parameters TaxZip and TaxCountry, respectively

select the value that reflects the action taken by a tax service implemented at the cart

(default) – the cart uses the main Stone Edge parameter settings

Tax Tables – the cart uses the Stone Edge tax table

Tax System - Calc – the cart performs a tax calculation at a 3rd party tax service

Tax System - Saved – the cart performs and saves a tax calculation at a 3rd party tax service

Tax System - Paid – the cart performs, saves, and pays the taxes at the 3rd party tax service

the cart-based account number assigned by Avalara

the cart-based license key provided by Avalara

the cart-based service URL provided by Avalara

the cart-based company code provided by Avalara

this is only used in special cases and the value is provided by Avalara

when selected, sets cart-based system parameter AlwaysCalcTaxAtImport to TRUE

if cleared, cart-based system parameter AlwaysCalcTaxAtImport is set to FALSE

when selected, sets cart-based system parameter AllowCancelWithUnvoidableTax to TRUE

if cleared, cart-based system parameter AllowCancelWithUnvoidableTax is set to FALSE

when selected, sets cart-based system parameter CalcTaxAtImportIfIncomplete to TRUE

if cleared, cart-based system parameter CalcTaxAtImportIfIncomplete is set to FALSE

when selected, sets cart-based system parameter CheckTaxRates to TRUE

if cleared, cart-based system parameter CheckTaxRates is set to FALSE

select this to save the cart-based system parameter changes before switching to another cart or your changes are lost

Monsoon Stone Edge Tax System Dashboard

Created: 8/20/14

Revised: 5/28/15

Published: 08/19/15